Markets

Mortgage Rates Rise and Fall

After three weeks of increasing rates, this week the mortgage rates have declined once again. The 15-year fixed rates fell from 3.39 percent last week to 3.32 percent. These rates are most popular for mortgage owners refinancing their loan. In addition, the 30-year fixed mortgage rates fell from 4.37 percent last week to 4.28 percent this week. Mortgage rates have been fluctuating between 4.23 and 4.53 percent all year, which have been rather affordable. "Mortgage rates were down this week as real GDP was revised downwards to 2.4% growth in the fourth quarter of 2013," said Frank Nothaft, Freddie Mac's chief economist[1]. There are many potential reasons to explain the fall in mortgage rates with one of them being the harsh winter weather we have faced. However, with the winter weather settling down and if the issues in Ukraine are solved, we should see mortgage rates pick back up.

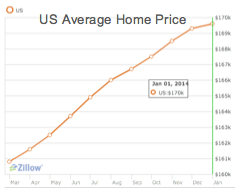

From a Microeconomic perspective, there are benefits to these mortgage rates decreasing. Homes are still relatively affordable. The average price of a pre-owned home is approximately $188,900, which is down roughly 20 percent from the peak in the market in 2006[2]. For first time buyers, mortgage rates are very low, so with a decent job and savings, first time buyers should be able to find a deal. In addition, about a third of the home buying has been cash buyers by investors, but this is suspected to decrease in 2014. If rates were to rise, this would cause the banks to loosen their strict requirements to obtain a mortgage making it much easier to acquire a loan.

After three weeks of increasing rates, this week the mortgage rates have declined once again. The 15-year fixed rates fell from 3.39 percent last week to 3.32 percent. These rates are most popular for mortgage owners refinancing their loan. In addition, the 30-year fixed mortgage rates fell from 4.37 percent last week to 4.28 percent this week. Mortgage rates have been fluctuating between 4.23 and 4.53 percent all year, which have been rather affordable. "Mortgage rates were down this week as real GDP was revised downwards to 2.4% growth in the fourth quarter of 2013," said Frank Nothaft, Freddie Mac's chief economist[1]. There are many potential reasons to explain the fall in mortgage rates with one of them being the harsh winter weather we have faced. However, with the winter weather settling down and if the issues in Ukraine are solved, we should see mortgage rates pick back up.

From a Microeconomic perspective, there are benefits to these mortgage rates decreasing. Homes are still relatively affordable. The average price of a pre-owned home is approximately $188,900, which is down roughly 20 percent from the peak in the market in 2006[2]. For first time buyers, mortgage rates are very low, so with a decent job and savings, first time buyers should be able to find a deal. In addition, about a third of the home buying has been cash buyers by investors, but this is suspected to decrease in 2014. If rates were to rise, this would cause the banks to loosen their strict requirements to obtain a mortgage making it much easier to acquire a loan.