Markets

The Housing Market and Bad Weather in January

Monday, March 3, 2014

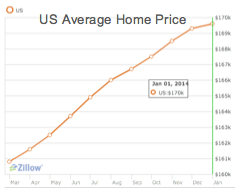

Zillow.com

All the snowy and frigid weather in the month of January has not only affected the market for hot chocolate and firewood, but also the real estate market. United States home sales have slumped 5.1 percent this January, making January the worst month for home sales in the past eighteen months. The harsh wintry weather is thought to be one of the main reasons for this drastic fall in home sales. From January to December, home building fell 16 percent. Snowstorms and freezing temperatures have caused potential buyers to stay home and sit by the fireplace instead of risking going out to visit open houses.

The seasonally adjusted annual rate of home sales falling has caused a deceleration in the number of homes bought from 2013—the best year in the past 7 years in the number of homes sold with a little over 5 million homes sold. "Such a picture confirms that the U.S. housing market reached its peak at the end of 2013 and further reacceleration is unlikely near term," Annalisa Piazza of Newedge Strategy said in a research note.[1]Although the harsh weather seems like a sensible reason for the decline, little supply of homes and increased prices have also impacted the lack of home purchases. In the West, where harsh wintry weather would not be a reason, buying fell nearly 7.3 percent. That was more of a decline than the Northeast and Midwest, where the winter storms were a significant factor. Western homes’ median cost is $273,500, which is nearly double the median cost of a home in the Midwest.

In addition, the median price of a home nationwide has risen almost 11 percent in the last year causing less demand in the market. Only 26 percent of home sales went to first time buyers; this number would normally be pushing 40 percent in a healthy market. Investors have been buying more and more homes, which is demonstrated by the all cash sales reaching nearly 33 percent of the purchases for last month. In the past two policy meetings, the Fed has reduced bond purchases from 85 million to 65 million dollars. This reduction may decrease long-term interest rates and stimulate more borrowing, spending, and employing to try to alleviate this decline.

[1] Boak, Josh. "US Home Sales Plunged 5.1 Percent in January - WSPA." The Associated Press. WSPA, 21 Feb. 2014. Web.

Monday, March 3, 2014

|

| Zillow.com |

All the snowy and frigid weather in the month of January has not only affected the market for hot chocolate and firewood, but also the real estate market. United States home sales have slumped 5.1 percent this January, making January the worst month for home sales in the past eighteen months. The harsh wintry weather is thought to be one of the main reasons for this drastic fall in home sales. From January to December, home building fell 16 percent. Snowstorms and freezing temperatures have caused potential buyers to stay home and sit by the fireplace instead of risking going out to visit open houses.

The seasonally adjusted annual rate of home sales falling has caused a deceleration in the number of homes bought from 2013—the best year in the past 7 years in the number of homes sold with a little over 5 million homes sold. "Such a picture confirms that the U.S. housing market reached its peak at the end of 2013 and further reacceleration is unlikely near term," Annalisa Piazza of Newedge Strategy said in a research note.[1]Although the harsh weather seems like a sensible reason for the decline, little supply of homes and increased prices have also impacted the lack of home purchases. In the West, where harsh wintry weather would not be a reason, buying fell nearly 7.3 percent. That was more of a decline than the Northeast and Midwest, where the winter storms were a significant factor. Western homes’ median cost is $273,500, which is nearly double the median cost of a home in the Midwest.

In addition, the median price of a home nationwide has risen almost 11 percent in the last year causing less demand in the market. Only 26 percent of home sales went to first time buyers; this number would normally be pushing 40 percent in a healthy market. Investors have been buying more and more homes, which is demonstrated by the all cash sales reaching nearly 33 percent of the purchases for last month. In the past two policy meetings, the Fed has reduced bond purchases from 85 million to 65 million dollars. This reduction may decrease long-term interest rates and stimulate more borrowing, spending, and employing to try to alleviate this decline.

[1] Boak, Josh. "US Home Sales Plunged 5.1 Percent in January - WSPA." The Associated Press. WSPA, 21 Feb. 2014. Web.

No comments:

Post a Comment